Financials

Financials

Condensed Interim Financial Statements For The Six Months Ended 30 June 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Interim Consolidated Financial Statements For the six months period ended 30 June 2025

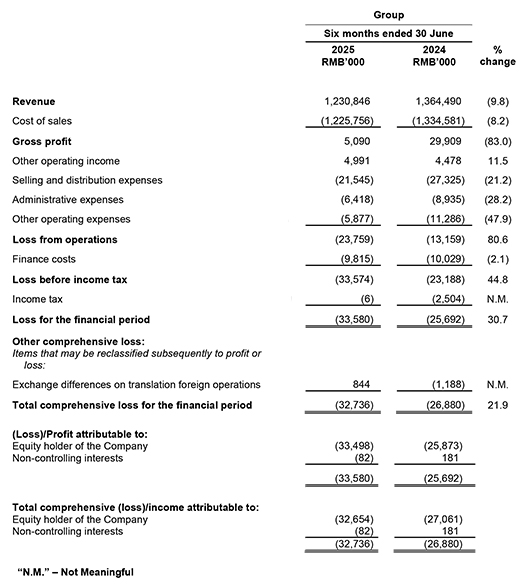

Condensed Consolidated Statement of Profit or Loss and Other Comprehensive Income

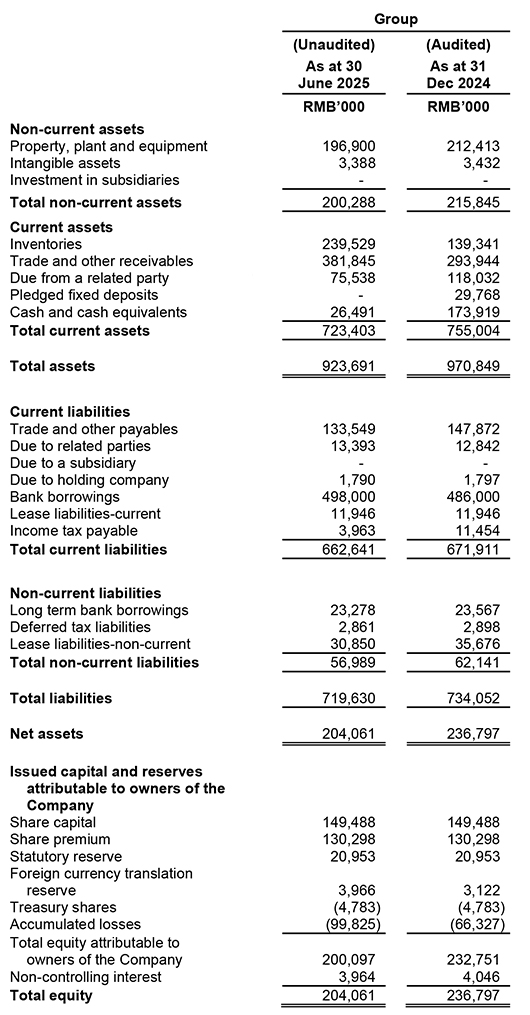

Condensed Statements of Financial Position

Review of Performance

Review of performance of the Group

Condensed consolidated statement of profit or loss and other comprehensive income

For six months ended 30 June 2025 ("FY2025 1H") vs six months ended 30 June 2024 ("FY2024 1H").

Revenue

Revenue from LPG sector decreased by approximately 9.86% or RMB 134.4 million from RMB 1,362.1 million in FY2024 1H to RMB 1,227.8 million in FY2025 1H due to fierce competition and weak demand in FY2025 1H in the liquefied petroleum gas ("LPG") market. Sales volume of LPG fell from 291,553 tons in FY2024 1H to 263,828 tons in FY2025 1H. Solar power generation recorded RMB 3.1 million revenue in FY2025 1H and it was RMB 2.3 million in FY2024 1H.

Gross Profit

Gross profit decreased by RMB 24.8 million or 82.9% from RMB 29.9 million in FY2024 1H to RMB 5.1 million in FY2025 1H due to the price fluctuation and fierce competition in LPG market. The average market price dropped from RMB 5,166 per ton in January to RMB 4,856 per ton in June, resulting in fierce competition in sales market. Meanwhile, the price fluctuation of LPG also impacted on our cost of sales, which narrowed our gross profit margin from 2.19% in FY2024 1H to 0.41% in FY2025 1H.

Other operating income

Other operating income increased from RMB 4.5 million in FY2024 1H to RMB 5.0 million in FY2025 1H. The increase of RMB 0.5 million or 11.1% was mainly attributed to the increase in government subsidy of RMB 0.8 million for import and export.

Selling and distribution expenses

Selling and distribution expenses decreased by RMB 5.8 million or 21.2% from RMB 27.3 million in FY2024 1H to RMB 21.5 million in FY2025 1H due to decrease in marine freight and land freight.

Administrative expenses

Administrative expenses decreased by RMB 2.5 million or 28.2% from RMB 8.9 million in FY2024 1H to RMB 6.4 million in FY2025 1H mainly due to decrease in salaries and wages.

Other operating expenses

Other operating expenses decreased by RMB 5.4 million or 47.9% to RMB 5.93 million in FY2025 1H from RMB 11.3 million in FY2024 1H is mainly due to decrease in bank charge of RMB 2.9 million and decrease in foreign exchange loss of RMB 2.3 million.

Finance costs

Finance costs decreased by approximately RMB 0.2 million or 2.1% from RMB 10.0 million in FY2024 1H to RMB 9.8 million in FY2025 1H mainly due to the interest on bank borrowings.

Profit attributable to equity holders

As a result of the above, the Group recorded net loss attributable to equity holders of RMB 33.5 million in FY2025 1H, compared with net loss of RMB 25.9 million in FY2024 1H.

Condensed statements of financial position

Non-current assets

Non-current assets decreased by RMB 15.5 million or 7.2% from RMB 215.8 million as at 31 December 2024 to RMB 200.3 million as at 30 June 2025 mainly due to the depreciation of fixed assets and amortization of right-of-use assets.

Current assets

Current assets decreased by RMB 31.6 million or 4.2% from RMB 755.0 million as at 31 December 2024 to RMB 723.4 million as at 30 June 2025. This is mainly due to the decrease on cash and cash equivalent of RMB 147.4 million and due from a related party of RMB 42.5 million, partially offset by the increase on inventories of RMB 100.2 million and trade and other receivables of RMB 87.9 million.

Current liabilities

Current liabilities decreased by approximately RMB 9.3 million or 1.4% from RMB 671.9 million at 31 December 2025 to RMB 662.6 million at 30 June 2025. This is mainly due to the decrease in trade and other payable of RMB 14.3 million, partially offset by the increase in bank borrowings by RMB 12.0 million.

Non-current liabilities

Non-current liabilities decreased by RMB 5.2 million was mainly due to the decrease on lease liabilities.

Condensed consolidated statement of cash flows

The Group recorded cash and cash equivalents of RMB 26.5 million as at 30 June 2025. The net decrease of RMB 148.3 million from cash and cash equivalents at 31 December 2024 mainly arose from the settlement of trade and other payable and increase of inventory.

Net cash used in operating activities amounted to RMB 175.1 million mainly due to cash utilized in working capital contributed by loss before tax amounting to RMB 33.6 million, an increase on trade and other receivables of RMB 97.7 million and a decrease on trade and other payable of RMB 16.7 million, offset by a decrease in amount due from related parties of RMB 47.2 million.

Net cash used in investing activities amounted to RMB 5.0 million was mainly due to acquisition of property, plant and equipment for the wharf upgrade and improvement.

Net cash generated from financing activities amounted to RMB 31.9 million mainly due to proceeds from fixed deposits of RMB 29.8 million and proceeds from bank borrowings of RMB 486.0 million, partially offset by repayment of bank borrowings of RMB484.1 million.

Commentary

According to IMF's latest prediction, the GDP growth in the People's Republic of China (PRC) would be 4.6% year-on-year in FY2025. The Liquefied Petroleum Gas (LPG) market is expected to continue experiencing dynamic changes over the next 12 months, driven by evolving global energy demands, shifting geopolitical factors, and advancements in energy technology. The growing focus on sustainability and cleaner energy solutions is likely to increase the adoption of LPG as an alternative to traditional fossil fuels, particularly in emerging economies.

The market will need to navigate challenges such as regulatory changes, competitive pressures from alternative energy sources like electric and hydrogen-powered technologies, and regional disparities in LPG pricing. Due to the uncertainties of geopolitical factors remaining in international energy market and recovering domestic market demand, the LPG market remains challenging and volatile. Ouhua would constantly keep making endeavor to capture opportunities from crisis.

Since entering the solar power generation market, electricity has steadily become a stable contributor to our revenue. We will continue to proactively engage in the green energy market, . With the ongoing support of our customers, bank, shareholders, and other stakeholders, Ouhua remains dedicated to achieving sustainable growth.